Introduction

In the dynamic world of finance, certain institutions shine brighter than the rest, captivating investors with their steadfast journey of growth and resilience. One such remarkable entity is Western Alliance Bank (WAB), a leading financial institution that has been turning heads with its exceptional performance and stock market success. In this article, we delve into the unique factors that have contributed to WAB’s impressive growth, explore the challenges it has overcome, and analyze the future prospects that lie ahead for this banking giant.

1. A Brief Overview Of Western Alliance Bank

western alliance bank stock, headquartered in Phoenix, Arizona, is a subsidiary of Western Alliance Bancorporation, a publicly traded company (NYSE: WAL). Since its inception in 2003, the bank has consistently demonstrated its commitment to innovation, customer-centricity, and sound financial management. As a result, it has steadily risen through the ranks of the financial sector, making it a prominent player in the industry.

2. Key Factors Contributing To Western Alliance Bank’s Success

2.1. Robust Risk Management One of the cornerstones of Western Alliance Bank’s success is its robust risk management practices. Unlike some of its counterparts, the bank has a disciplined approach to risk, diligently monitoring its exposure and maintaining strict underwriting standards. By being prudent in its lending practices, the bank has managed to weather economic downturns and minimize losses during challenging times.

2.2. Focused Market Segmentation WAB has strategically focused on specific market segments, such as commercial and industrial lending, real estate development, and technology and healthcare finance. By honing in on these areas, the bank has developed deep expertise, allowing it to better serve its customers and gain a competitive advantage in these niches.

2.3. Emphasis on Technology Recognizing the transformative power of technology, WAB has invested significantly in digitizing its operations and enhancing customer experiences. Through the deployment of cutting-edge digital solutions, the bank has improved operational efficiency, streamlined processes, and created a seamless banking experience for its clients.

2.4. Strong Leadership and Corporate Culture Behind every successful enterprise is a strong leadership team and a positive corporate culture. WAB’s executive leadership has been instrumental in driving the bank’s strategic vision, while its culture fosters innovation, collaboration, and a customer-first mentality, which permeates throughout the organization.

3. Overcoming Adversity: Navigating The 2008 Financial Crisis

The 2008 global financial crisis was a litmus test for many financial institutions, and Western Alliance Bank was no exception. However, unlike numerous banks that struggled to survive during the economic meltdown, WAB managed to emerge relatively unscathed. Its prudent risk management practices, diversified portfolio, and conservative lending policies allowed it to navigate the storm with resilience.

4. Recent Performance And Growth Trajectory

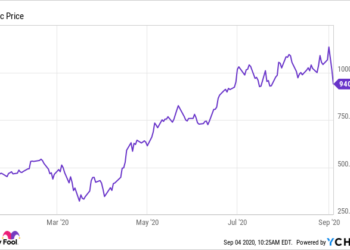

Over the past few years, Western Alliance Bank has continued to showcase its financial prowess. Its revenue growth, net income, and asset expansion have been noteworthy, attracting investors seeking stable and rewarding opportunities in the financial sector. The bank’s stock performance has been commendable, consistently outperforming market benchmarks and earning the trust of investors.

5. Future Prospects And Challenges

5.1. Market Expansion and Acquisitions Western Alliance Bank is poised to explore new opportunities for expansion, both geographically and through strategic acquisitions. As it ventures into new markets, it will face the challenge of adapting to diverse regulatory environments and cultural differences.

5.2. Technological Advancements In a rapidly evolving digital landscape, the bank must continue to stay ahead of the curve by investing in emerging technologies, such as artificial intelligence, blockchain, and data analytics. Failure to do so could result in losing ground to competitors and impeding future growth.

5.3. Regulatory Compliance As a financial institution, WAB is subject to stringent regulatory oversight. Compliance with ever-changing regulations can be an ongoing challenge, requiring substantial resources to ensure adherence while avoiding potential penalties.

Conclusion

Western Alliance Bank’s journey from a nascent financial institution to a stalwart in the banking industry is a testament to its commitment to innovation, risk management, and customer satisfaction. By focusing on its core strengths, adapting to evolving market dynamics, and capitalizing on emerging opportunities, the bank has forged a remarkable success story.

FAQs

Q1: How has Western Alliance Bank’s stock performed compared to its competitors? A1: Western Alliance Bank’s stock has outperformed many of its competitors in the financial sector, with consistent growth and positive returns. However, it’s essential to compare individual performance against specific peer groups and market conditions to gain a comprehensive perspective.

Q2: What distinguishes Western Alliance Bank from other major banking institutions? A2: Western Alliance Bank stands out for its focused market segmentation, robust risk management, and emphasis on technological innovation. Unlike some larger banks that may lack agility, WAB’s streamlined operations and customer-centric approach have contributed to its exceptional performance and continued growth.